us japan tax treaty withholding rate

2 Saving Clause in the Japan-US Tax Treaty. Pension funds are exempt under certain conditions.

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged.

. With Regard to Non-resident Relatives. 4 The term US. 1 US Japan Tax Treaty.

You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30 rate. Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that. 62 rows All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report and withhold.

February 21 2022 how do carters reward points work. 2013 Technical Explanation of Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation. Us japan tax treaty dividend withholding rate.

United States of America 0 1 10 0 2 0 2 1. 96 rows Exempted when paid by a company of Japan holding at least 15. What is the difference between fifa and uefa.

Us japan tax treaty dividend withholding rate. Posted on February 21 2022 by. Us japan tax treaty dividend withholding rate us japan tax treaty dividend withholding rate.

Napit fire alarm course. Japan Inbound Tax Legal Newsletter August 2019 No. Rate of withholding tax Interest.

This table lists the income tax and. 30 10 30. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

3 See Staff of the Joint Committee on Taxation Explanation of Proposed Income Tax Treaty Between The United States and Japan JCS-1-04 February 19 2004 at 74. 4 Saving Clause Exemptions. 0 0 0 Note that a rate of 49 applies in the case of interest and certain dividends where a Tax File Number is not quoted to the payer.

Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc. Large holders of a REIT are not exempt 15315. A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the.

5 Article 5 Permanent Establishment in the Japan-US. Rates National income tax rate Taxable income Rate JPY 18000001 JPY 40000000 40 4084 including surtax Local inhabitants tax rate 10 plus per capita levy of JPY 4000. For definition of large holders.

Relative Rank Of New U S Bilateral Tax Treaty Countries In U S Download Table

Form 8833 Tax Treaties Understanding Your Us Tax Return

Gatsby Netlify Cms Starter Us Tax Rejection Petition

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Doing Business In The United States Federal Tax Issues Pwc

Avoiding Double Taxation Expat Tax Professionals

The Us Japan Estate Inheritance And Gift Tax Treaty Youtube

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Irs Form 8833 And Tax Treaties How To Minimize Us Tax

Gatsby Netlify Cms Starter Us Tax Rejection Petition

Should The United States Terminate Its Tax Treaty With Russia

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

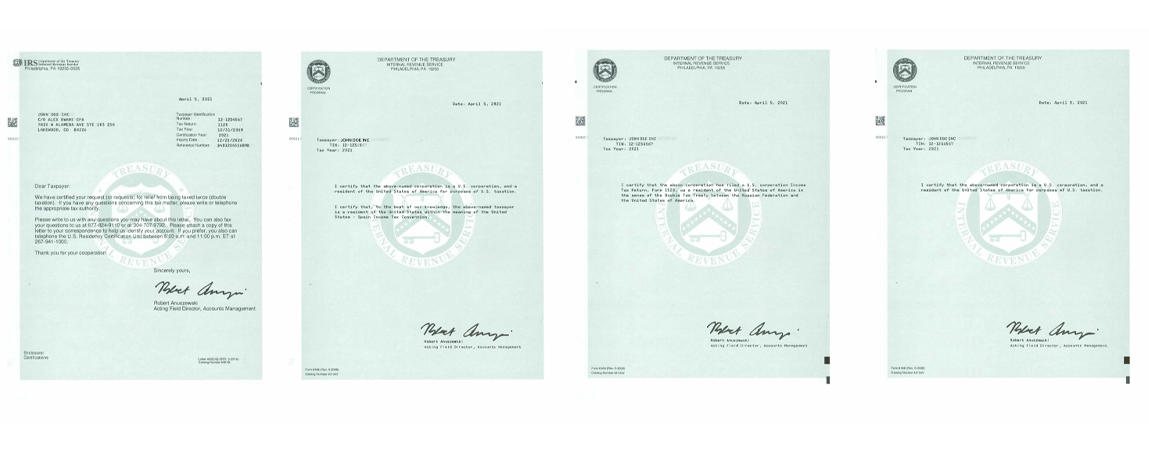

Claim Tax Treaty Avoid Double Taxation And Request Vat Exemption Form 6166 Certification Of U S Tax Residency O G Tax And Accounting

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

U S Estate Tax For Canadians Manulife Investment Management

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog